On Tuesday 5th December, 2017, the Institute of Economic Affairs (IEA) organized a round table conference under the theme, “ A Decade After Oil Discovery in Ghana: The Economic Impacts and Policy Implications.” The call upon Government at the end of the conference by Prof. John Asafu Adjaye of the IEA to take steps to ” review Oil Contracts with extractive firms” was in the right direction.

However, to say: “We rushed to produce oil and we did not get the governance framework in place before starting production, ” and to blame the abysmal situation we found ourselves, in terms of petroleum revenue currently accruing to Ghana on PNDC Law 84 is completely untrue and false. There was a proper governance framework backed by PNDC Laws 64 and 84 which support the world.standard norm, the Production Sharing Agreement (PSA) fiscal regime which all African countries newly into oil exploration are adopting.

The fact that previous NPP/NDC Administrations decided to ignore this existing legal framework and signed contracts based on Royalty tax/ Hybrid Systems not backed by the laws in our legal books, account for the grave and abysmal situation we found ourselves in as a nation. .If we had consolidated the PSA which the PNDC Laws 64 & 84 supported, the situation would have been far different, as shown in the analysis below.

Act. 919 of 2016 was hurriedly passed to legitimize the Royalty Tax/Hybrid System contracts which are responsible for the less than 20% of total production revenue accruing to Ghanaians, the Sovereign owners of the oil and gas resources.

“ The new Law is…garbage, ” declared Dr. Raymond A. Atuguba , at the ” Ghana Oil Conference” held on January 11th -13th 2017 at Labadi Beach Hotel, in Accra.

That sums it up aptly!

PNDC Law 84- Production Sharing Agreement (PSA)

If Ghana had adopted the world standard norm, the PSA, which PNDC Law 84 supports, and without participating in the project with NO COST to incur and depending upon the terms of the agreement, Ghana could have earned one of the following. Note: Participating is optional under PSA. Under PNDC Law 84, Ghana has 60days to give notice of Participation when commercial discovery is made. It allows Ghana to contribute to costs in order to earn more revenue.

OPTION 1-PROFIT OIL ONLY

If under the PSA Ghana opts to take Profit Oil Only without Royalty, Tax Oil and not participating, Ghana could have earned 105,599,593 barrels of Oil worth US$ 8,967,939,835, representing 47.60% of total production revenue with NO COST to Ghana as against 35,827,088 barrels worth US$3,042,610, 146 representing 16.10% with corporate taxes of US$520,464, 156 and gas revenue of US$9.856,621 added (total US$3,563,074,302), making it 18.95% with cost implications under the Ghana Hybrid System.

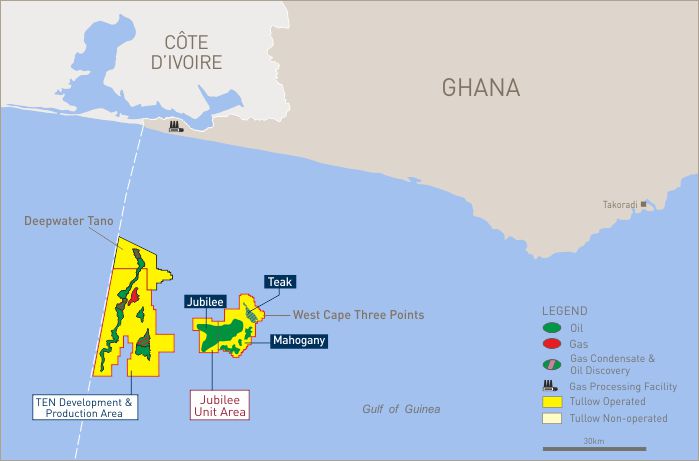

Already, by 30th September, 2017, Ghana has contributed to the Jubilee Fields capital and operating costs US$579,043, 118, a needless cost which would not have been incurred under PSA. Besides, with TEN and Sankofa coming on stream, Ghana would be paying roughly US$180m per year for the next 10 years for capital and operating costs (World Bank Report, June 2013).

OPTION 2 -ROYALTY+ PROFIT OIL

Under Option 2 whereby Ghana Opts for Royalty and Profit Oil without payment of Tax Oil and Participating Interest, Ghana could have earned 110,027,249 barrels worth US$ 9,343,954,094 representing 49.60% of total production revenue at NO COST as against 35,827,08 barrels worth US$ 3,042,610,146 and the corporate taxes and gas revenue but with the cost implications under the Ghana Hybrid System.

OPTION 3-ROYALTY + Tax Oil+ PROFIT OIL

Under Option 3 which conforms and falls in line with the provisions in PNDC Law 84, Ghana could have earned 133,117,474 barrels of Oil worth US$ 11,304,868,408, representing 60.10% of total production revenue at NO COST to Ghana as compared to 35,827,088 barrels worth US$ 3,042,610,146 plus the corporate taxes and gas revenue with the costs so far incurred.

Cumulative total losses to Ghana as at 30th September 2017 is thus US$ 7,741,794,106 for not

adopting PSA which PNDC Law 84 supports.

The above expected earnings under the PSA fall within the Minimum Government Take range of 42% – 60% of total production revenue that a host government is entitled to, set by the US Government Accountability Office (GAO), for allowing its Oil resources to be exploited under any Oil Contract.

Which of these two contract types or fiscal regimes should Ghana have adopted?

We, the members of FTOS-PSA CAMPAIGN in Ghana challenge the Institute of Economic Affairs to come out and prove us wrong and prove how PNDC Law 84 “was outdated by the time we started producing Oil, which made the contracts unfavorable to Ghana,” according to Prof. John Asafu Adjaye. For us, Prof. Raymond A. Atuguba has summed up what we think of Act. 919.

We once again call on the government and other bodies supporting the Hybrid System to a public debate on this very important national issue, if they are indeed sincere about taking Ghana from the hole that it is in to beyond aid and economic emancipation at last.

Solomon Kwawukume

Senior Research Officer (GIGS)

National Coordinator FTOS-GH PSA Campaign (0246449104)

Read the Original Document here

Image source: https://www.tullowoil.com/our-operations/africa/ghana/jubilee-field/